Amini, a Nairobi-based climate tech startup focused on solving Africa’s environmental data gap through artificial intelligence and satellite technology, has raised $2 million in a pre-seed funding round.

Pale Blue Dot, the European climate-focused venture capital firm that announced a $100 million fund last week, led the oversubscribed round. At the same time, Superorganism, RaliCap, W3i, Emurgo Kepple Ventures and a network of angel investors participated.

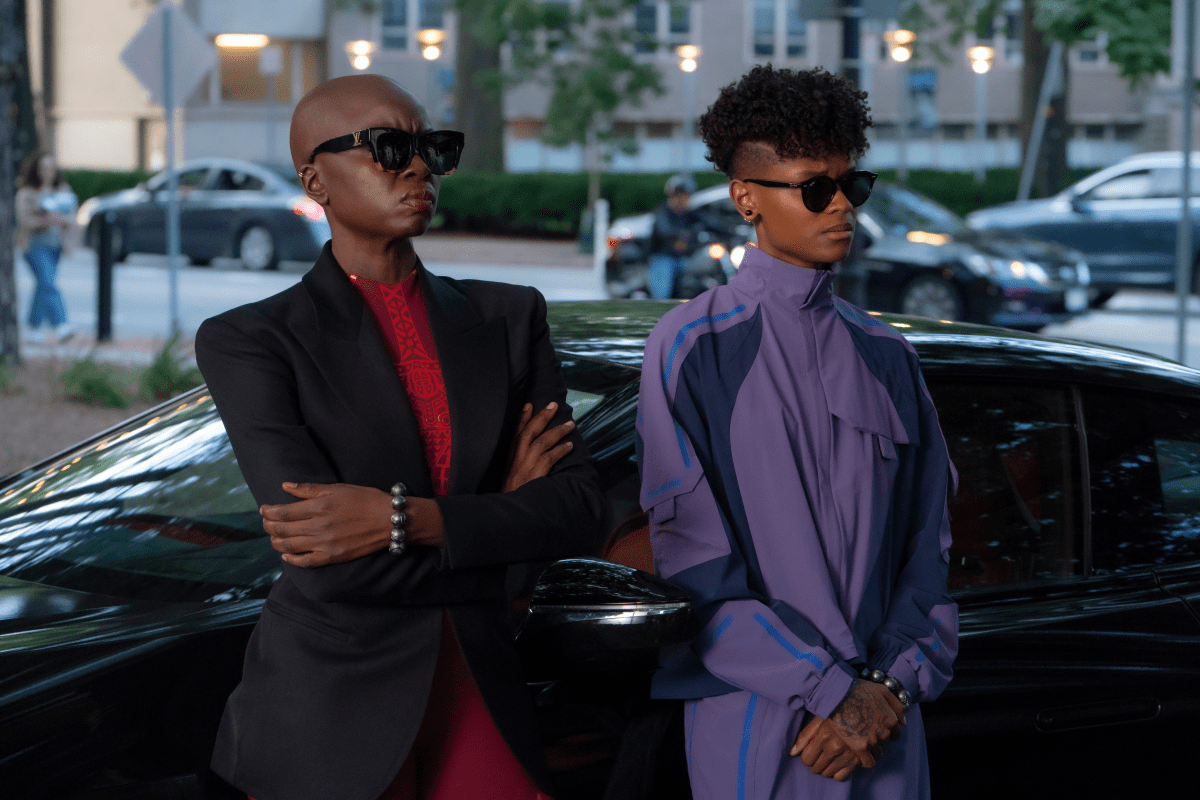

Kate Kallot, the founder and CEO of Amini, has worked for several years in artificial intelligence, machine learning, data science and deep tech roles for companies such as Arm, Intel and Nvidia. Kallot, in an interview with TechCrunch, explained how a work presentation on the intersection of natural capital and emerging technologies made her become fascinated by how she could use her experiences in AI and ML, including her work around social impact with the United AI Alliance, to provide a solution to the continent’s lack of data infrastructure, especially around environmental data.

“The lack of data infrastructure for Africa, from the inability to collect data to analyzing it and its impact, is a deeper problem than most realize,” the CEO said on a call. “If you look at climate or environmental data in Africa today, it’s either nonexistent or difficult to access. And with climate change projected to hit Africa the most, there’s a lack of data for farmers, for instance, to understand what’s happening.”

Often lauded as the last frontier market, Africa is home to 65% of the world’s uncultivated fertile land and 30% of its mineral resources, but only accounts for 3% of global GDP. In addition, frequent food and water scarcity still plague the continent despite having such enormous resources. One reason for this is the lack of reliable and trustworthy data, which has held back Africa’s development for decades by hampering business decisions and capital allocation, as well as making it difficult to measure the impact of climate change. There are other instances of nothingness in accessing weather or geospatial data on the continent.

Enter Amini. The six-month-old startup said it has developed a data aggregation platform that pulls in different sources of data (from satellites and other existing data sources like weather data, sensors and proprietary customer data) down to a square meter, then unifies and processes this data before providing them via APIs local and international companies that need them.

Today, on a granular level, Amini can provide farmers with data from the cycle between crop planting and harvesting to the amount of water and fertilizer used. On a higher level, the platform can help organizations understand the impact of natural disasters, flooding and drought across the entire continent “in a few seconds,” according to Kallot, who also said the platform could pull from almost 20 years of historical data and current data produced every two weeks.

Kate Kallot (Amini founder and CEO). Image Credits: Amini

Amini’s current customers, primarily corporations and multinationals, are in the agricultural insurance sector and supply chain monitoring, specifically at the “last mile,” or the initial stages of the global supply chain. Kallot couldn’t disclose the names of Amini’s clients, while adding that the less-than-a-year-old climate tech startup is in discussions to sign up “some of the biggest food and beverage companies and one of the largest insurance companies globally.”

Addressing the lack of environmental data for organizations in these industries effects a necessary change. Take, for instance, global food and beverage companies with franchises in Africa, such as Nestlé or Starbucks. There’s mounting pressure from international regulators such as the SEC Climate Disclosure rules and European Green Deal mandating that these companies understand their carbon emissions and environmental impact and how their operations and supply chain processes affect local farming practices in various regions, including Africa.

Platforms like Amini bring much-needed data transparency for these global organizations with vested interests in Africa, and helps them tackle supply chain issues at the last mile and provide agricultural insurance to farmers. “The beauty of the platform is that it’s easily scalable because once you collect agricultural data for insurance, for example, that same data, 80 to 90%, can be sold into food and beverage companies who have supply chains in Africa or can be sold to governments who are trying to understand the impact of agriculture on their country.”

Amini’s business is such that it engages in a long sales cycle. International clients get access to the platform’s API after paying a flat license fee “in the multi-millions” for two years. Local clients have tiered introductory pricing on a case-by-case basis, allowing them to access what they need and grow over time.

Gro Intelligence, a Kenyan-founded but New York-based AI-powered insights company that provides decision-making tools and analytics to the food, agriculture and climate economies and their participants, is the name that comes up the most when industry observers try to make sense of Amini’s business, according to Kallot. However, the chief executive says there are noticeable differences: Amini collects and generates the data that the likes of Gro aggregate and use to illuminate the inter-relationships between food, climate, trade, agriculture and macroeconomic conditions.

Kallot says Amini, which recently became the first African company accepted into the Seraphim Space Accelerator program (scouts from the top 2% of global early-stage space companies), has direct competition with geospatial companies such as Planet Labs that have deployed a constellation of satellites that collects data around the globe and provide access for $15 per square kilometer. According to Kallot, using such technology is quite expensive for organizations in Africa or looking into the continent, and Amini proffers an alternative.

This piece highlights that venture capital activity around climate tech has been heating up in Africa since last year despite the global VC funding cooldown. Last year, the continent’s climate tech startups secured over $860 million in equity funding. Firms such as Novastar Ventures, Catalyst Fund and Equator are raising or have raised climate-tech funds for pre-seed to Series A startups.

Commenting on why her firm, which typically writes checks to European climate tech startups, invested in Amini, an African startup, Heidi Lindvall, general partner at Pale Blue Dot, said: “The scarcity of high-quality environmental data in Africa is a concern as it prevents others from building important climate solutions such as improving farmer insurance, monitoring climate risk or supply chains. When meeting the team behind Amini, we were blown away by their ambition and expertise and we believe they are best positioned to fill the environmental data gap of Africa.”

Before launching Amini, Kallot was a co-founder and chief impact officer at African web3/crypto Mara. Mwenda Mugendi, Muthoni Karubiu and Eshani Kaushal, all part of Amini’s executive team, bring a wealth of experience in machine learning, data science, geospatial analysis and fintech, working for multinationals including Microsoft, NASA and MTN.

.png)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·